Why Quartz Tubes Are Non-Negotiable in

Key Sectors

Laboratory Equipment

42% of EU labs now use quartz tubes for VOC analysis and high-purity reactors

(EuroLab Report, 2022).

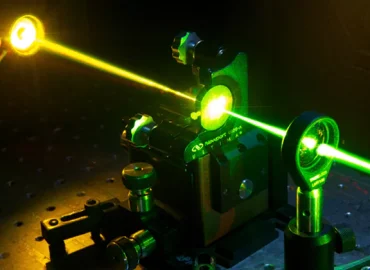

Optical Systems

UV-grade tubes dominate 75% of photolithography and laser cavity setups in US tech hubs

(Photonics Media Survey, 2023).

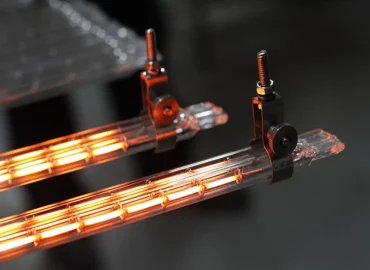

Industrial Heating

US renewable energy firms rely on >1,100°C-rated tubes for silicon ingot production—30% demand growth since 2020.

Critical Needs

Tubes must withstand thermal cycling (>1,000°C gradients) while maintaining >92% transmittance for IR temperature monitoring.

Why Buyers Are Fed Up With Traditional Suppliers

Purity Inconsistencies

33% of EU buyers report SiO₂ grades below 99.99% in non-certified tubes, causing devitrification in semiconductor-adjacent applications.

Lead Time Delays

Avg. EU/US lead times for custom diameters (OD 50–200mm) exceed 14 weeks, per 2023 Industrial Materials Index.

Critical Needs: Tubes must withstand thermal cycling (>1,000°C gradients) while maintaining >92% transmittance for IR temperature monitoring.

MOQ Constraints

60% of small-scale labs avoid quartz due to rigid 100-unit order thresholds.

Hidden Costs

60% of small-scale labs avoid quartz due to rigid 100-unit order thresholds.

TOQUARTZ Rethinking Quartz Tubes for Western Markets

TOQUARTZ® reshapes procurement with:

Custom Sizing

Tubes tailored to OD 10–300mm (±0.05mm tolerance) and lengths up to 3m.

Purity Guarantees

99.99–99.995% SiO₂ (trace metal <0.5ppm) validated via ICP-MS reports.

Responsive Logistics

US/EU warehouses cut lead times to 2–4 weeks for bulk orders.

Cost Efficiency

No MOQ + per-unit pricing lowers entry barriers for startups and academic labs. Case in point: A Dutch solar R&D hub saved €18k/year by switching from bulk purchasing to on-demand tube sourcing.

For labs, engineers, and OEMs across the Atlantic, the future of quartz is here: high-purity, hassle-free, and hyper-focused on your success.